Bloxflip Crash Predictor

The Bloxflip Crash Predictor is a financial device that aims to revolutionize the way we understand market crashes. In this text, we delve into the inner workings of this predictive model, its motive, and the conditions for leveraging its energy.

Try To Use Predictor!Bloxflip Crash Predictor – How it works?

- Information Aggregation

on the center of the Bloxflip Crash Predictor lies a sophisticated algorithm that aggregates extensive amounts of historic financial statistics. This consists of inventory charges, buying and selling volumes, volatility indices, financial indicators, or even sentiment evaluation from social media platforms. The model thrives on statistics range, making sure a complete know-how of market dynamics.

- Machine mastering Magic

Powered by device getting to know strategies, the Bloxflip Crash Predictor learns from styles and anomalies inside the facts. It identifies diffused correlations, hidden triggers, and early warning signs and symptoms that precede market downturns. The model adapts through the years, continuously improving its accuracy.

- Feature Extraction

The predictor extracts relevant functions from the data, together with:

- Volatility traits: analyzing the volatility index (VIX) and its deviations.

- Sentiment evaluation: Scouring social media posts for worry, panic, or euphoria.

- Technical signs: RSI, MACD, moving averages, and more.

- economic occasions: interest charge adjustments, geopolitical tensions, and financial reports.

- Predictive Modeling

The coronary heart of the machine is a predictive version that mixes various capabilities. It employs strategies like logistic regression, neural networks, and ensemble techniques. with the aid of assessing the chance elements, it assigns chances to potential marketplace crashes.

Why Bloxflip Crash Predictor matters

- Early Warnings

The Bloxflip Crash Predictor presents early warnings, permitting buyers, buyers, and economic institutions to take preventive measures. whether it’s adjusting portfolios, hedging positions, or diversifying assets, well timed action can mitigate losses.

- Systemic threat assessment

via quantifying systemic risk, the model contributes to monetary balance. It identifies vulnerabilities throughout markets, sectors, and asset training. Regulators can use this facts to implement targeted regulations.

- Algorithmic trading strategies

state-of-the-art buying and selling algorithms can contain the predictor’s alerts. whether or not it’s triggering prevent-loss orders or dynamically adjusting positions, computerized systems gain from predictive insights.

Conditions

To harness the energy of the Bloxflip Crash Predictor, remember the following:

fine facts assets: dependable and complete economic data is crucial. make sure get admission to to real-time feeds and historic databases.

Machine learning understanding: understanding the underlying algorithms and their barriers is essential. Collaborate with statistics scientists and domain professionals.

Chance management Framework: enforce danger management protocols based totally at the model’s predictions. define thresholds for movement.

Moral Use: keep in mind that predictions are probabilistic. avoid panic-selling or irrational choices totally based on predictions.

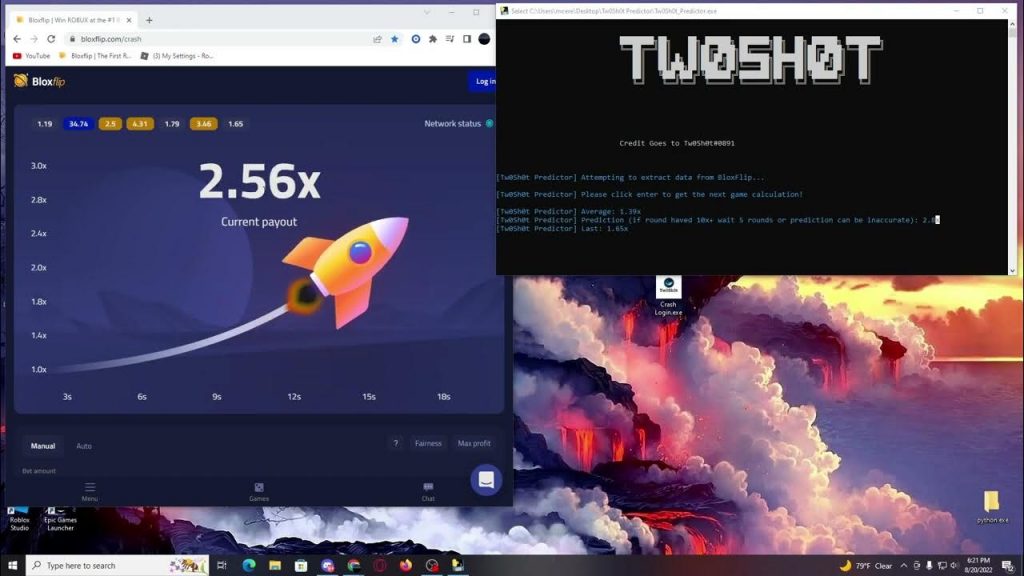

Random number predictor

This kind of predictor uses a RNG (random quantity generator) to generate a very random crash multiplier. generally the ones scams are bought as a Discord bot where you placed the spherical identification and you get returned the faux prediction. occasionally there’s also an app that you could down load.

Predictors based on “preceding recreation stats”

those applications typically load the preceding historic information of the video games, and practice a few arbitrary mathematical formulation in an attempt to predict the next final results.

each Bloxflip game final results is completely unrelated with all of the other preceding ones. this means, that this form of evaluation isn’t correct in any respect and it’s no one-of-a-kind than the opposite form of predictor. you could read greater in this newsletter Gambler’s fallacy – Wikipedia

Conclusion

The Bloxflip Crash Predictor transcends traditional market analysis. It empowers stakeholders with foresight, reworking market crashes from catastrophic surprises to doable events. As monetary landscapes evolve, this device remains at the forefront, guiding us in the direction of a more resilient and knowledgeable destiny.

Disclaimer: The Bloxflip Crash Predictor is a effective tool, but no prediction machine is infallible. constantly workout due diligence and consult monetary experts earlier than making funding selections.